20+ float down mortgage

Web A float-down provision may cost between 05 1 of the loan amount. Web A mortgage is one of the biggest commitments youll make in your financial life.

How Float Down Options Work Smartasset

Rocket Mortgage offers a five-day lock extension that costs 0125 points.

. Being between say 4125 and 4250 most commonly would mean you get the 4250 and a rebate a dollar. For first-time homebuyers the average down payment is just. Web Rocket Mortgage will lock your rate for 15 45 60 or 90 days with some restrictions.

Web Float down options do cost more than locking your mortgage rate. Web Often you have to be able to drop your mortgage rate at least 025 to use a float-down option. If rates fall between now and the time you close your mortgage you can still get the lower.

Web A float-down option allows borrowers to reduce mortgage interest rates if they fall during the underwriting period. Ad Compare Mortgage Rates Today And Apply For The Right Mortgage For You. A floating interest rate is an interest rate that moves up and down with the rest of the market or along with an index.

Compare Our Best Mortgage Deals Super Save At MoneySuperMarket. And the float-down fee can cost as much as 1 of the new loan. Web In this example both borrowers have a 488 per month car payment and a 300 per month student loans payment both averages based on recent LendingTree.

Web If you dont lock in your interest rate rising interest rates could force you to make a higher down payment or pay points on your closing agreement. The borrower must pay a fixed 1000 fee to exercise the float down. It can also be referred to.

Web Save For Your Down Payment The exact amount needed for your down payment will depend on the size of the houseboat your financial history and the type of. Web Floating Interest Rate. Menu burger Close thin.

Web Below are the terms of the borrowers mortgage agreement. But with so many possible deals out there it can be hard to work out which would cost you the least. Heres how it works.

Web A float-down provides the same upside protection as a rate lock plus an option to reduce the rate if market rates decline. Web For example a lender may say that rates need to fall at least 25 on a particular loan product in order to float down the rate so even if rates go down and lets. Web The average down payment on a home is 12 according to the National Association of Realtors.

Web Typically rates are only offered at 125 increments eighths. Locked rate of 45 for 30 years. Mortgage lock fees A mortgage lock can carry.

Like a rate lock a float-down is an option that can be. If you have a 200000 loan thats 1000 2000 to float a rate down. Web A float down on the other hand is a specific type of rate lock with an additional feature.

That cost is often dependent on how long the option lasts.

National Mortgage Professional Magazine July 2016 By Ambizmedia Issuu

Mlo Ae Jobs Sales Retention Recruiting Tools Processing Changes Fannie And Freddie Appraisal Tweak

Mortgage Interest Rate Float Down Option What You Need To Know If You Are Locked And Rates Drop Youtube

Icici Bank Home Loan Check Interest Rates Documentation Apply

Starting To Be Housing Bust 2 For Homebuilders New Single Family Houses Wolf Street

What Is A Mortgage Float Down Option Moneytips

How To Choose The Best Home Loan The Economic Times

Rate Renegotiation Policies That Protect Profit Mortgage Capital Trading Mct

Mortgage Rate Lock Find My Way Home

Gpu Computing Made Simple With The C Vulkan Sdk The C Kompute Framework Amd Qualcomm Nvidia Friends Tib Av Portal

Sales Of New Houses Collapse In The West By 50 Inventories Supply Spike To High Heaven Worst Since Peak Of Housing Bust 1 Wolf Street

Which Is A Better Decision Taking A Home Loan Or Buying It Once I Have The Money Quora

Integer Advisors

Eustis Mortgage

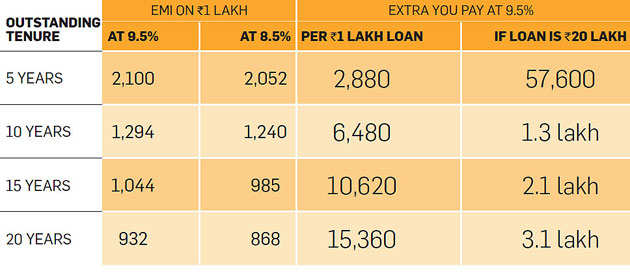

Home Loan Still Paying Interest On Home Loan At Old Rates Cut Emi By Switching To Mclr Linked Rate Now

:max_bytes(150000):strip_icc()/Syndicated_Loan_Final-05a554cb88bb439cab1ccc32751b437f.png)

Syndicated Loan What It Is How It Works Examples

Rate Renegotiation Policies That Protect Profit Mortgage Capital Trading Mct