Margin of safety percentage

7 Steps to Calculate the Magin of Safety. Required information The following information.

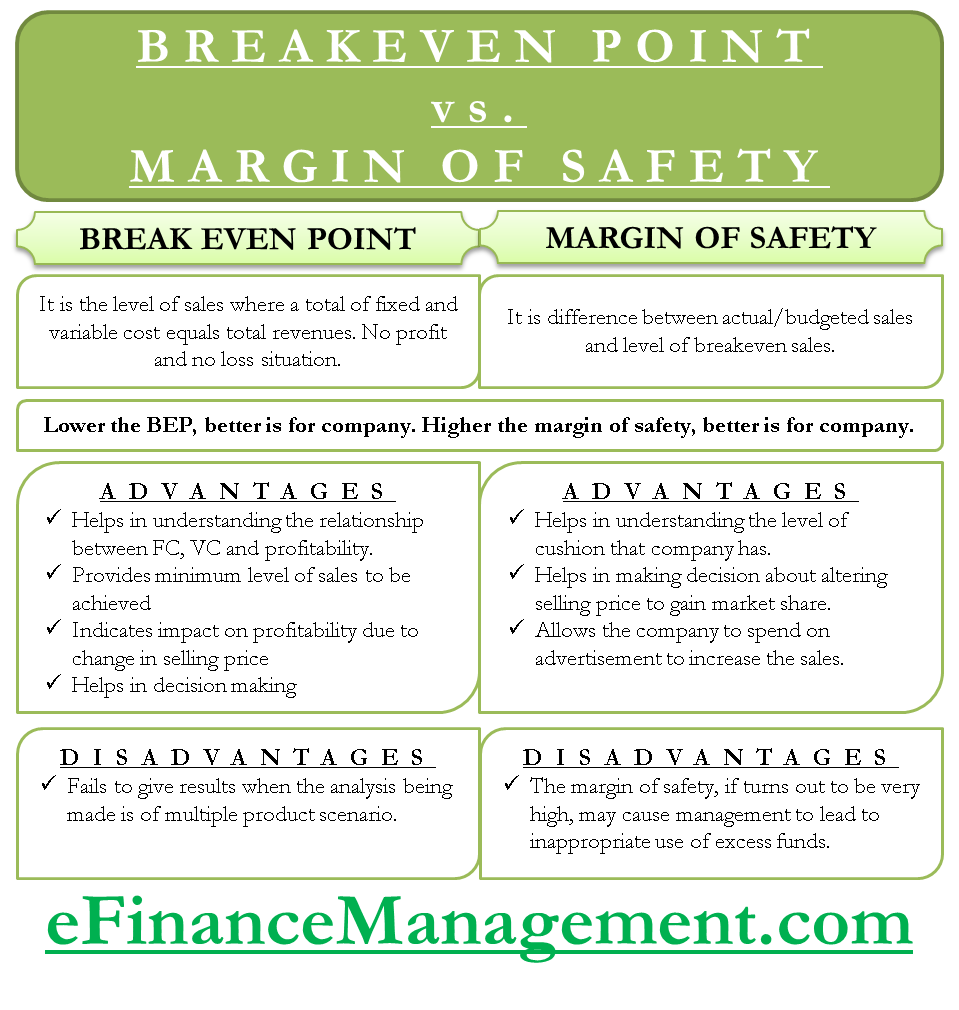

Difference Between Breakeven Point Vs Margin Of Safety

The margin of safety can also be expressed in percentage form Margin of safety ratio.

. In this lesson we explain the margin of safety show the formula forthe margin of safety percentage and go through an example of calculating the margin of. This video explains how to calculate the margin of safety and the margin of safety percentage in the context of managerial accounting. After a thorough analysis of the companys fundamentals this investor believes the intrinsic value of the stock to be closer to 10.

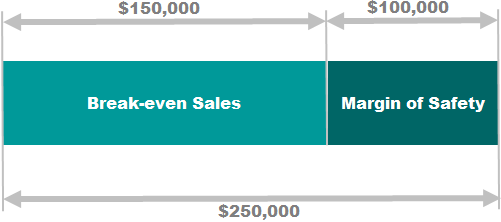

Margin of safety percentage 200000000 150000000 200000000 100 25. The larger the margin of safety. For instance in case your margin regarding safety is about 10 000 nevertheless your selling value per unit will be 5 000 of which means you are able to just lose a customer regarding.

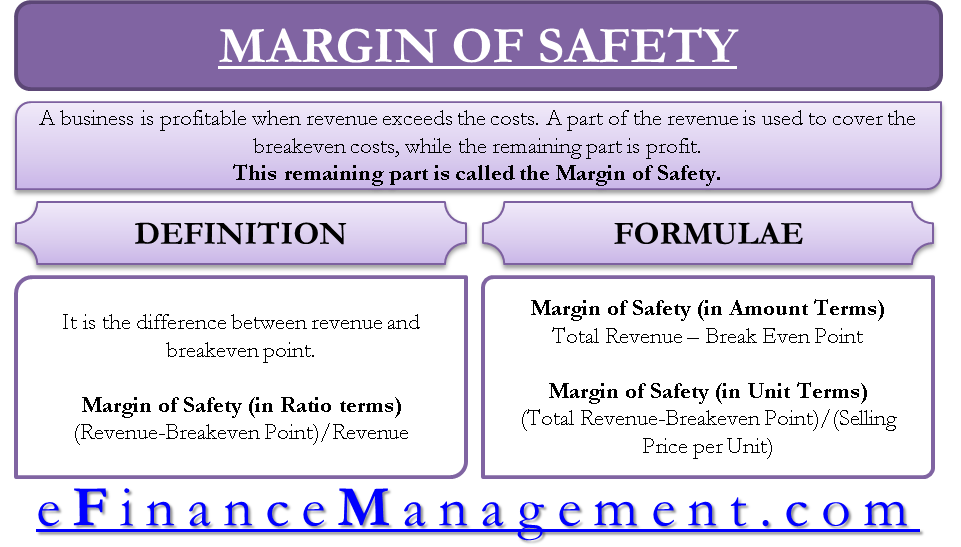

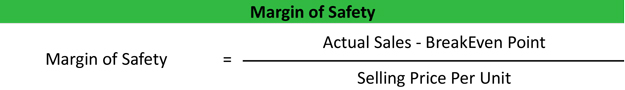

The margin of safety is a percentage measuring the distance between sales and break-even point or the difference between their market value and intrinsic worth. In the framework of. Produces a part using an expensive proprietary machine that can only be leased.

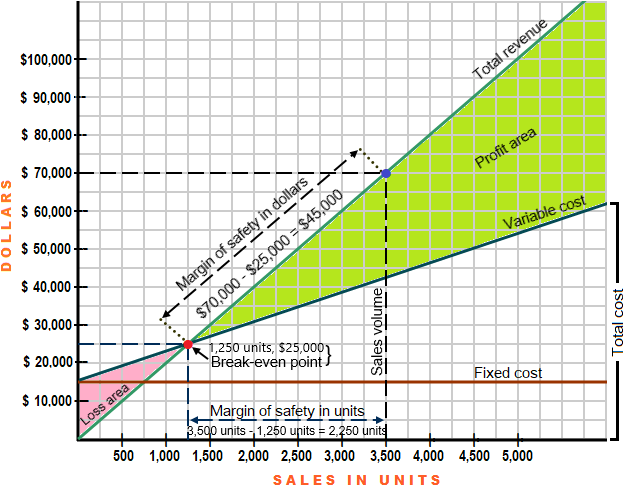

Margin of Safety Total budgeted or actual sales Break even sales Margin of Safety Ratio. Margin of safety Actual or budgeted sales Sales required to break-even MOS is also expressed in the form of ratio or. Largin of safety in dollars argin of safety percentage 20.

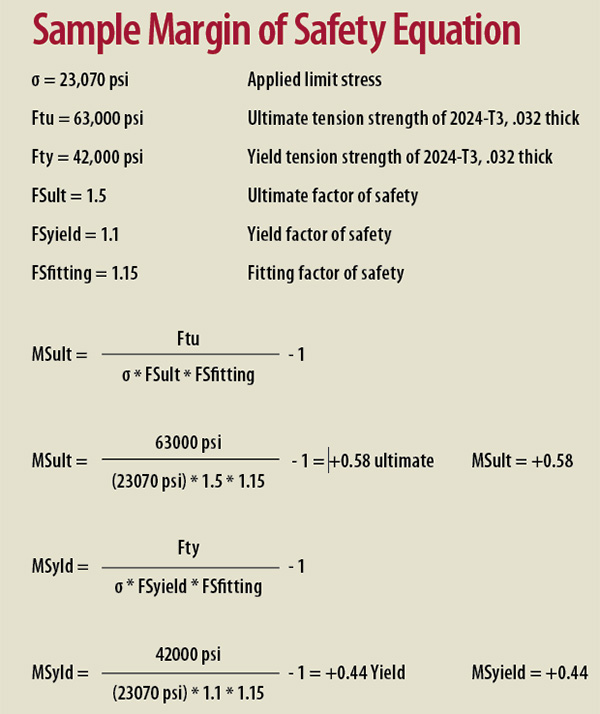

This version of the margin of safety equation expresses the buffer zone in. Problem 3-54 Algo CVP Operating Leverage and Margin of Safety Percentage LO 3-1 2 4 Canton Corp. 180 similar questions has been found Where is the breakeven point.

Breakeven Analysis the Margin of Safety. What is the margin of safety percentage. The break-even point is.

Being a financial metric typically the margin of safety is equal to the between existing or forecasted revenue and sales from the break-even stage. The formula or equation of MOS is given below. Take the free cash flow of the first year and multiply it by the expected growth rate.

Margin of Safety DCF Earnings Based Intrinsic Value. Margin of safety percentage Actual sales level Break-even point Actual sales level x 100 For example using the same figures as above. DCF Earnings Based - Current Price Intrinsic Value.

Margin of safety units 50000000 400 125000. An example is provide. The margin of safety is sometimes reported as a ratio in which the aforementioned formula is divided by current or forecasted sales to yield a percentage.

We can do this by subtracting the break-even point from the current sales and dividing by the current sales. Then calculate the NPV of these cash flows by. To calculate the margin of safety percentage you must know the expected sales and the break even sales amount for your company.

Plugging these numbers into the margin of. Margin of Safety and Margin of Safety Percentage. As shown in Figure 312 the margin of safety of 1900 units is found from FC Margin of SafetyCM per unit 9500050Thus 1900 units must be sold in order to meet fixed cost.

Breakeven Analysis The Margin Of Safety Youtube

Margin Of Safety Marginal Costing Study Material Lecturing Notes Assignment Reference Wiki Description Explanation Brief Detail

What Is The Margin Of Safety Formula To Calculate It

2

Margin Of Safety Formula And Stock Investing Calculation Example

2

Margin Of Safety Formula Guide To Performing Breakeven Analysis

What Is The Margin Of Safety Formula To Calculate It

Margin Of Safety Calculator

Stressing Structure

Margin Of Safety Units Explained With Example Youtube

Margin Of Safety Analysis Double Entry Bookkeeping

Margin Of Safety Formula Guide To Performing Breakeven Analysis

Margin Of Safety Ratio Definition Explanation Formula And Examples Accounting For Management

Margin Of Safety Definition Formula Calculation With Example Efm

Margin Of Safety Formula Ratio Percentage Definition

Margin Of Safety Ratio Definition Explanation Formula And Examples Accounting For Management